Welcome to Sports Betting Online

At SBO.net, we do things differently. We cut through the noise of the online betting world to bring you insights that make a real difference. We have put the hours into researching what different betting companies have to offer which means we can recommend the best ones to you.

Top Recommended Bookmakers – April 2024

Average Payout Speed

0 – 24 HoursCurrencies

- AUD

- CAD

- USD

- Competitive sign-up and promotional offers

- Excellent statistics section to aid customers

- Pain-free deposit options

- Accepts both high and low limit bettors

- Lengthy and expensive withdrawal procedure

Average Payout Speed

0 – 24 HoursCurrencies

- BTC

- LTC

- ETH

- Premier destination for US bettors

- Racebook covering daily races

- Esports and virtual sports markets

- In-depth sports stats and tips

- Intuitive live betting markets

- Limited withdrawal options

Average Payout Speed

0 – 24 HoursCurrencies

- LTC

- USD

- Generous bonuses and promotions

- Great range of betting markets

- Extensive racebook

- Very good customer service

- Only a few withdrawal options

- Fees for withdrawing funds

Average Payout Speed

0 – 24 HoursCurrencies

- BTC

- Trusted by publications such as ESPN

- Access a dedicated racing section

- Crypto-friendly sportsbook

- Adjust odds format and time zone

- Support options include call back

- Quite low sportsbook limits

Average Payout Speed

0 – 24 HoursCurrencies

- USD

- Accepts players from all over the world

- Known for their live betting offers

- Lots of secure banking options

- Great bonuses and promotions

- High fees for some deposit options

- Support agents are often slow to reply

Average Payout Speed

0 – 24 HoursCurrencies

- BTC

- Top-rated US online sportsbook

- Mobile site for iOS and Android users

- Diverse range of betting markets

- Excellent customer support options

- Lines come out very late in the day

- Odds not as favorable as other books

Average Payout Speed

0 – 24 HoursCurrencies

- BPS

- CAD

- EUR

- Popular book that accepts large max bets

- Huge focus on football and basketball

- High-spec live in-play platform available

- Downloadable client for Windows & Mac

- Odds are not amazing on non-US sports

- User interface could be improved

Online Betting vs Local Betting Shops

With more than 8,000 betting shops dotted across the United Kingdom, it’s odds-on that you’ll come across at least one when you walk down your local high street. But gone are the days of having to make a trip to the bookies to place your bet.

Nowadays, the benefits of online sports betting make placing bets on your desktop, tablet or smartphone far more attractive than visiting your nearest betting shop. We could quite literally write a book about why you should bet online instead of at betting shops, but the main advantages include:

✅ Convenience – There is no need to travel to your local betting shop. Simply log in via your desktop or mobile and place your bets anywhere, anytime.

✅ Better Odds – Betting shops have more overheads than sports betting sites. Therefore, you’ll receive consistently better odds when you bet online.

✅ Free Bets – How often does your local betting shop treat you to a free bet? Yeah, exactly. Betting sites constantly reward new and existing customers.

✅ Instant Payouts – Winning bets placed at betting shops mean you must make another trip to cash in your bet slip. Sports betting sites pay you instantly.

Why Choose SBO.net?

We started SBO.net with the intention of becoming the ultimate online sports betting hub.

Our aim is to share our knowledge and break down the barriers to understanding sports betting online.

We want to make it easy for you to get better at online betting. We do this by providing you with:

✅ Honest betting site reviews and ratings

✅ The latest free bets and sign-up bonuses

✅ Free tips from pro tipsters

✅ Easy to follow sports betting guides

✅ Proven strategies and staking plans

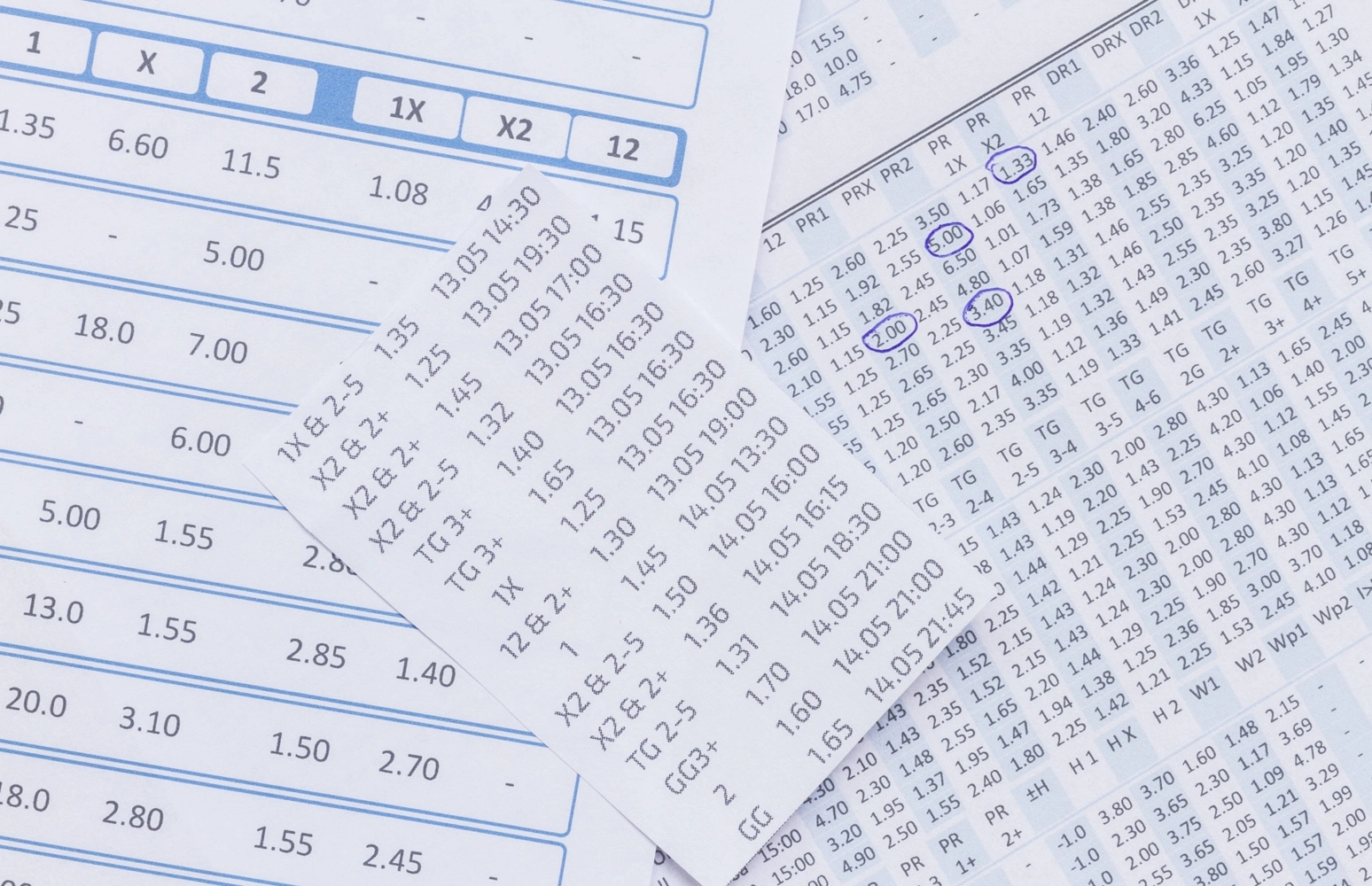

How to Find Value in Sports Betting

Because online betting covers every sport out there, we help you focus on identifying value bets and making money.

You’ll find that football and horse racing are the most popular sports to bet on in the UK. The bookies know it and offer you a huge choice of different bet types. That’s great news because it gives you more ways to gain a betting edge.

You can also make big profits in the lower leagues and less obvious markets too. Why? Because the more obscure the market, the more chance the bookmakers will get the prices wrong.

Use our extensive articles on different sports, strategies and tips to make the most of your bets.

How to Bet on Sports Online

Sports betting online is far quicker and easier than visiting your local betting shop. In addition to travel time, you must find a screen with the markets you’re interested in, write out a bet slip and then queue to place your bet with a member of staff. It’s a time-consuming process.

At sports betting sites, you can log in and place your bets in a matter of seconds. We have written a step-by-step guide to betting online to show you just how straightforward the process is.

Step 1

Create an account at one of our recommended online bookmakers.

Step 2

Navigate to the banking section and make your first deposit.

Step 3

Use the navigation links to find the sport you want to bet on.

Step 4

Click the odds to add the selection to your bet slip.

Step 5

Enter how much you’d like to bet and click the confirm button.

Step 6

Done! Now it’s time to put your feet up and watch the action unfold.

Online Gambling in Your Country

If you’re based outside the UK, you’ll have access to different bookies and offers. We’ve got you covered because we research the top online gambling sites all over the world.

Every time you visit SBO.net, you’ll see online betting sites and bonuses tailored to where you are. To find out more, check out our guide to gambling websites in your country.

Banking Options for Sports Betting Online

You should be able to deposit and withdraw with ease and without any fees. The bookies we recommend offer fast pay-outs, secure banking and reliability.

We only recommend online gambling sites that use top-level encryption technology, so you can rest assured that your details are safe.

Most online betting sites accept a range of deposit methods including debit and credit cards, PayPal, and even Bitcoin. If you’re not sure what’s best for you, we’ve put together a punter’s guide to the most popular banking options.

Featured Betting Sites

What Our Users Think

We always love to know what you think about our recommendations. Who are your favourite bookies? Who has the best offers? Let us know at info@sbo.net.

Here’s what some of our users had to say:

How We Rate the Best Online Bookmakers

We rate bookmakers based on some key factors, these are some of the things we look for:

Gambling Commission Approved

We only recommend the most secure betting sites that are licensed by national authorities like the UK Gambling Commission (UKGC). Scam operators are filtered out to ensure quality and reliability.

Great Choice of Sports Betting Markets

A wide choice of sports to bet on is a must, and we expect top sports like football to have plenty of bet types. If we spot good value markets anywhere, we want to make sure you can get your money on.

Good Selection of Free Bets and Promos

A good first deposit bonus is a great way for you to start. We also rate the online gambling sites that give you regular free bets, accumulator boosts, and loyalty bonuses.

Customer Support

Any decent bookie should give you helpful and professional customer service. We compare bookmakers on their level of support and quality of service.

Banking

We only promote online sports betting firms that follow secure banking practices. You need peace of mind that your payment details are safe, and we take that very seriously.

Mobile App

We like to see a good mobile app on Android and iOS from our top online bookmakers. If you’re betting while you’re in the crowd or you’re on the move, you need instant access from your phone.

In-Play Betting

Live betting means you can bet instantly and you’ll never miss a cracking punt because you missed kick off! You can also react to games as they go along which adds a whole new dimension to sports gambling.

Partial Cash Out

If your bet looks like winning, you can cash out early and take a profit without the risk of a late goal ruining your bet. Partial cash out is even better because you can lock in a profit and leave part of your bet running to see if it comes in.

Live Streaming

You can’t beat watching live sports when you’ve got real money down, and bookies that offer live streaming score well with us. It gets you closer to the action and you can make much better in-play bets.

Frequently Asked Questions

How does online sports betting work?

Is sports betting online popular?

What is the best sports betting site?

Is sports betting profitable?

Is online betting legal?